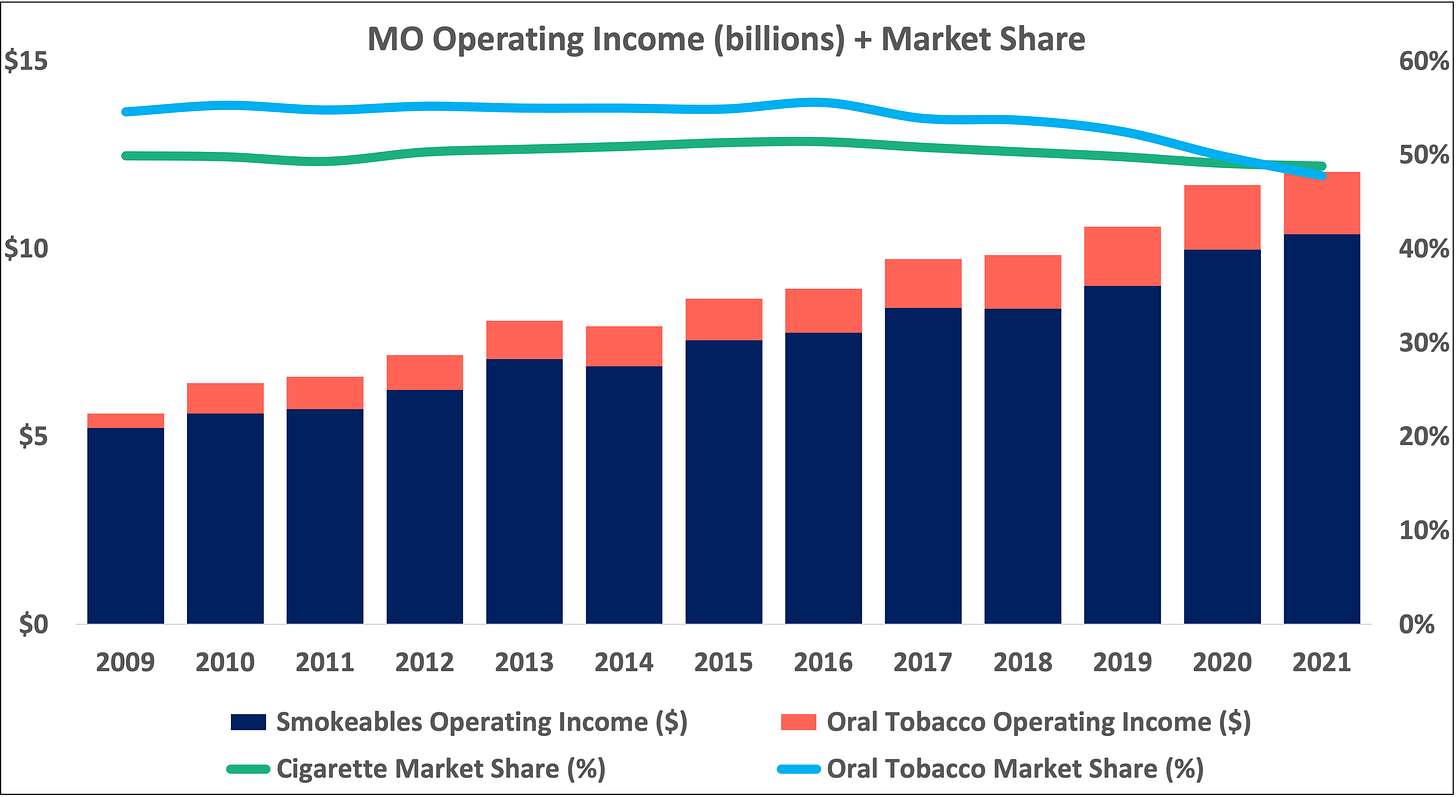

Profits from Altria’s combustibles business are at record highs despite its cigarette business losing market share every year since 2016. Why? Because:

(1) The pricing power of Altria’s products more than makes up for users switching to cheaper brands.

2) Marlboro is a juggernaut of a brand with virtually no market-share churn.

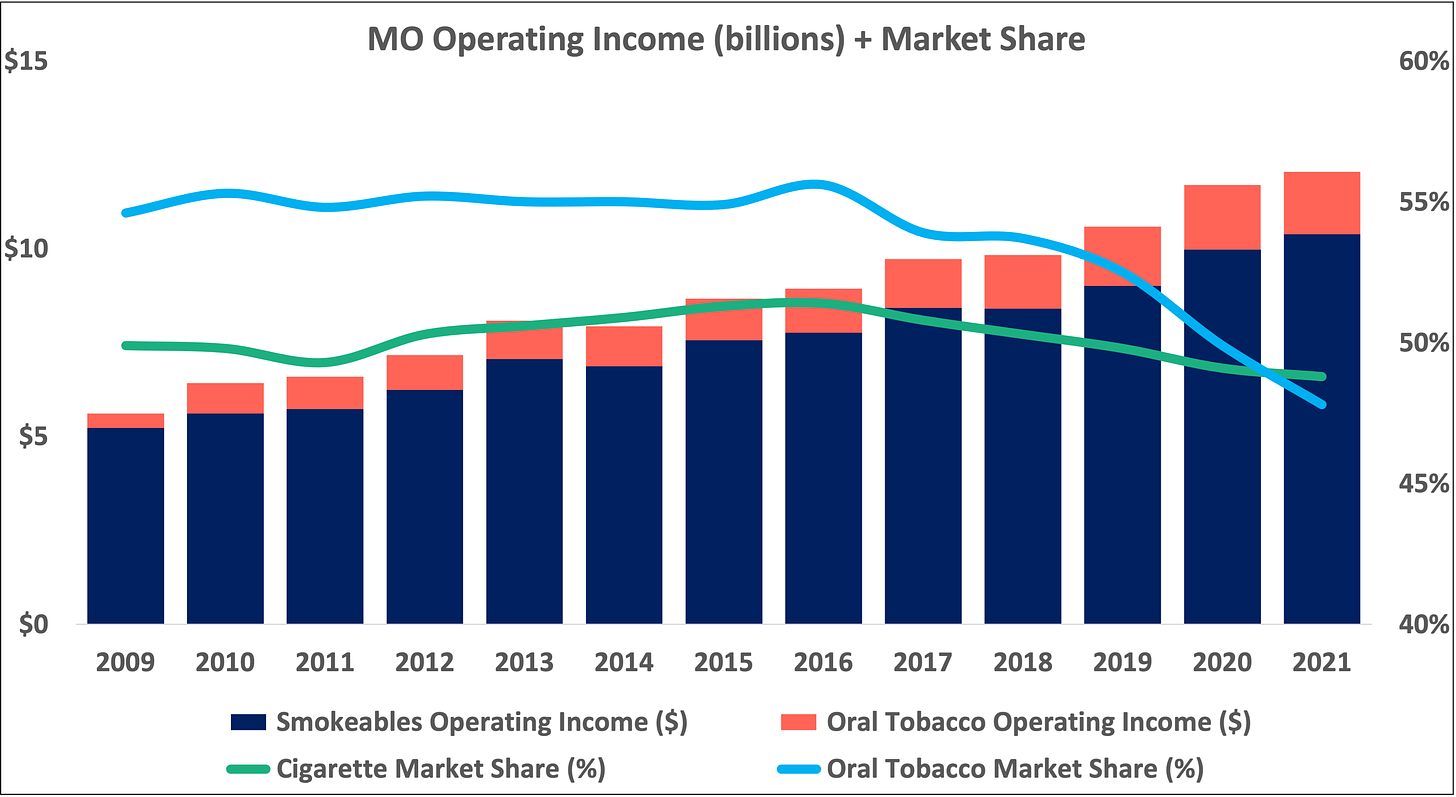

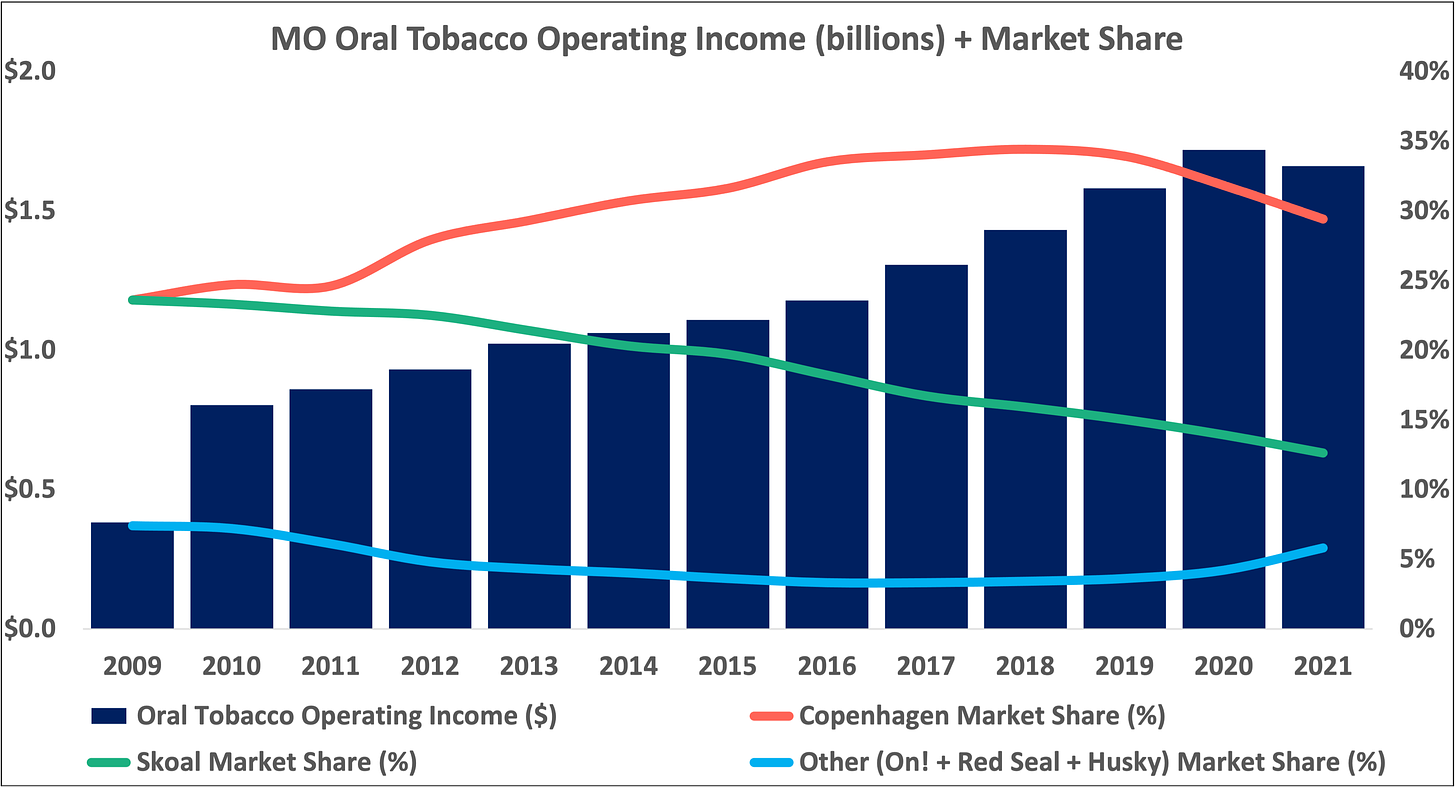

Zooming in on the y-axis below, Altria’s declining market share is clearer. The oral tobacco segment’s losses are steep because nicotine pouches are taking share from Altria’s traditional oral tobacco products. Altria’s On! product, while growing market share, has been unable to make up for Skoal and Copenhagen’s losses. Marlboro alone is propping up Altria’s market share in the cigarette space.

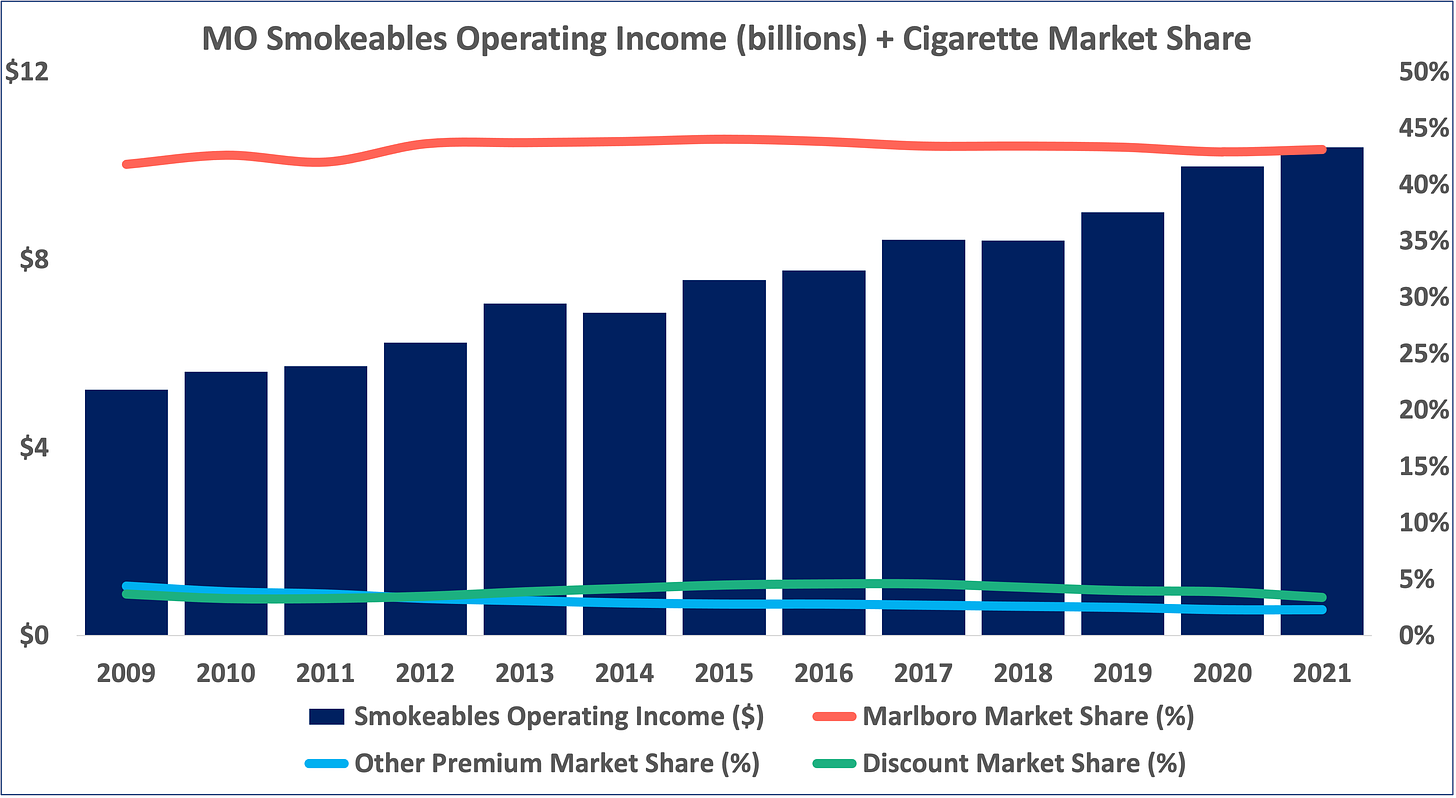

The Marlboro brand has held about 43% market share since 2012. Altria’s other premium and discount brands have lost share over the years, though they make up less than 5% of the market combined. Historically, Altria’s Black & Mild cigarillo brand has held around 30% market share in its category while volumes have increased over 40% since 2009 (though the cigarillo business is small compared to cigarettes).

On! and competing nicotine pouch products (e.g., Zyn and Velo) have been taking market share from Altria’s Skoal and Copenhagen brands. The nicotine pouch category is very competitive. Altria and its competitors have been cutting prices and promoting products with coupons in an effort to gain share. Because of that competition and traditional oral tobacco’s market share losses, Altria’s profits from its oral tobacco segment dropped for the first time ever in 2021.

Despite market share losses in its cigarette and oral tobacco segments, Altria’s ability to grow profits remains strong thanks to Marlboro.

Other pieces in this series on Altria: