Turkey 🇹🇷, Saudi Arabia 🇸🇦, the UAE 🇦🇪, Egypt 🇪🇬, Algeria 🇩🇿, and South Africa 🇿🇦 are among the countries that make up this market. PMI lumps in its international duty free business with ME&A for financial reporting purposes.

Africa’s population is over 1.3 billion and is growing at about 2.5% per year. The continent’s population is expected to reach 2.5 billion by 2050. Despite lower per capita income in Africa compared to that in PMI’s developed markets, the continent represents a significant growth opportunity for the company as Africans are expected to grow wealthier in the coming decades. And smoking rates in African countries are high:

30% of South Africans smoke.

23% of men in Morocco smoke.

20% of men in Kenya smoke.

42% of men in Egypt smoke.

36% of men in Algeria smoke.

25% of men in Zimbabwe and Zambia smoke.

From a long-term pricing perspective, this combination of population growth and prevalence in Africa is good news for PMI.

PMI’s Middle East market is more developed and has a population of over 200 million (PMI doesn’t do business in Iran or Syria) that is growing, but not as fast as Africa’s. Some populations, like Lebanon, are actually shrinking.

Among Middle Eastern countries, Turkey and Saudi Arabia are most important to PMI. They are the largest markets by population (85 and 36 million, respectively) and each is growing 1.5% per year. 30% of Turks smoke — a level of prevalence last seen in the United States in the 1970s. Over 30% of men in Saudi Arabia and the UAE smoke. Over 40% of Lebanon’s population smokes. In comparison, only 12-15% of Americans smoke.

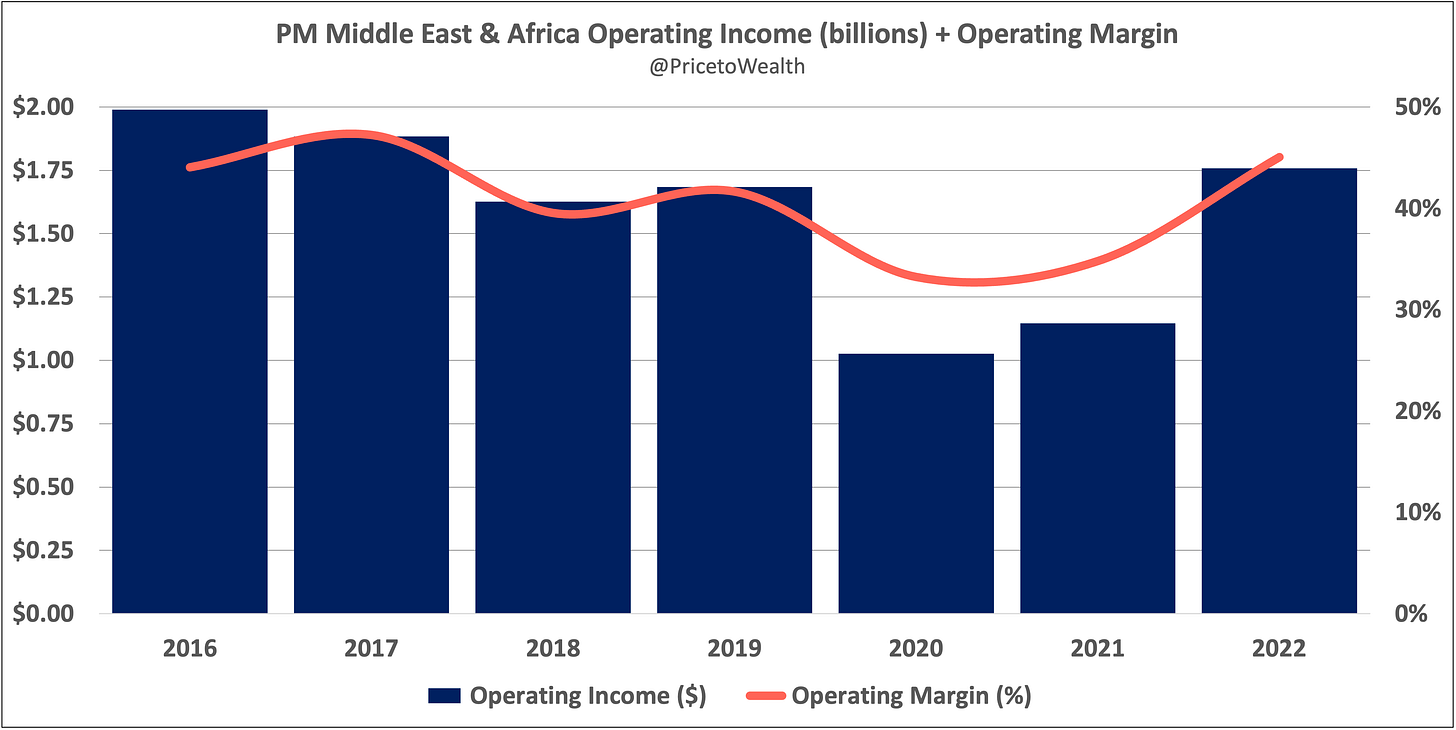

ME&A (plus the international duty free business) accounts for 12% of PMI’s revenue and 14% of its operating income.

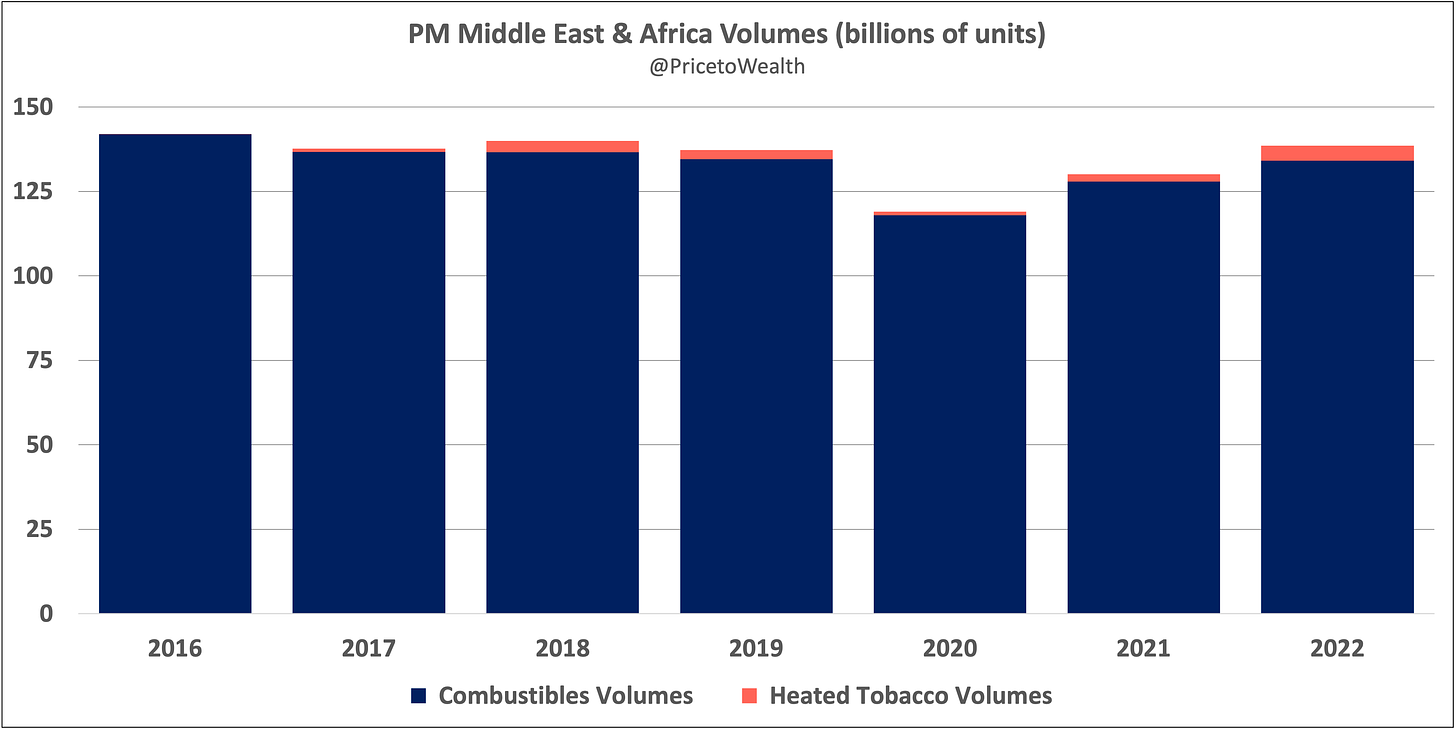

ME&A revenues are down 14% from 2016-2022. Operating income is down 12% during the same timeframe. Smoke-free revenue accounts for 9% of all revenue in ME&A. Total volumes are virtually flat (down 2% from 2016-2022) with heated tobacco accounting for just 3% of units sold. In other words, PMI’s volumes have held up remarkably well in ME&A, and the company’s smoke-free business hasn’t even scratched the surface.

The coronavirus pandemic put a pretty big dent in PMI’s ME&A business in 2020 and 2021. The international duty free business was down 62% in 2020 because of travel restrictions and reduced travel worldwide. PMI’s 2020 volumes in South Africa dropped 35.5% because of the government’s pandemic-related ban on all tobacco sales from March-August in 2020. Volumes in Turkey dropped 4% in part because of lockdown measures in 2020. As of 2022, revenues, volumes, and operating income have bounced back.

PMI’s efforts on the smoke-free front haven’t seen much success yet in the Middle East because of government restrictions on e-cigarettes. While e-cigarette use in Turkey and Saudi Arabia is permitted, e-cigarette sales are not. If management can unlock the regulatory shackles that are holding back e-cigarette sales in these markets, PMI’s performance in ME&A could later mirror the company’s success so far in Europe.

Thanks for reading.

Other pieces in this series on PMI:

The New and Improved Philip Morris International

Philip Morris International: Europe